Your bank calls and tells you they’re concerned about some of your recent checking account activity. It looks like you’ve been writing large checks to someone you don’t even know and they’re worried that your banking information has been stolen.

During an annual check of your credit report, you notice that there are several new credit card accounts listed that weren’t there last year. You don’t remember opening any new lines of credit and when you reach out to the companies, you’re told there’s been a fraudulent change of your mailing address.

You’re contacted by the Department of Justice about a pending criminal case against you. It seems as if there’s a civil judgment in your name for a crime you never committed. You could be prosecuted for something you didn’t do and it’s all because someone has been falsely using your identity to commit financial fraud.

These are just a few of the identity theft examples you might encounter if your personal info is ever stolen and used without your knowledge. The simple but scary truth is if you don’t know the basic identity theft facts, you could quickly become victimized by cybercriminals.

We’re here to help you answer the “What is identity theft and how can it be prevented?” question by guiding you step-by-step through everything you need to know about this dangerous digital threat and how to protect yourself from becoming the victim of identity thieves.

What is Identity Theft?

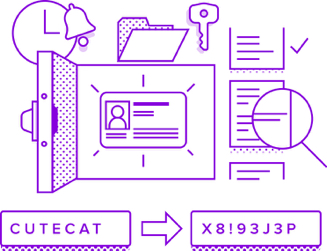

You’ve probably heard someone talking about identity theft or even heard it mentioned in the news. But what exactly is it? Simply put, identity theft is when someone steals your personal information (Social Security Number, bank account number, Driver’s License number, etc.) and uses it for fraudulent or criminal purposes.

Identity theft crimes range from using your information to apply for a line of credit to pilfering your tax refund. Some unfortunate identity theft victims actually have their entire lives stolen by a criminal assuming their identity and committing crimes in their name.

If that sounds terrifying to you, that’s because it truly is a frightening prospect. Imagine sitting at home with your family and having the police knock at your door. They’ve come to arrest you for a crime you haven’t committed, all because someone made a phony ID using your information.

There are thousands of such horror stories and many identity theft victims had no idea anything was wrong until it was far too late. So, what can you do to prevent becoming victimized by identity thieves? The first step is to get all the identity theft information you can, which is why we’ve created this comprehensive identity theft guide.

How Does Identity Theft Happen?

The scary truth is that identity theft can happen to anyone at any time. That’s because the sad reality is that criminals never stop looking for ways to steal your personal information and find ways to profit from it.

There are no more creative individuals than those looking to get something for nothing. Identity thieves are constantly coming up with new ways to steal from you and many of them make it their full-time occupation. But how exactly does identity theft happen?

These are the most common ways identity thieves gain access to your personal info:

Dumpster Diving: Criminals have no problem with digging through garbage to get any type of documentation with your personal information on it and then using it to steal from you.

Mailbox Theft: Identity thieves will boldly grab financial statements or credit card offers from your mailbox in broad daylight in an effort to steal your identity.

Email Phishing: Your identity can also be stolen online with phishing scams, which is where cybercriminals send you phony emails that look like they’re from friends or legitimate businesses, asking for you to verify your most sensitive information.

Card Skimming: Many criminals use a special device to electronically capture your debit or credit card information by placing it directly on ATMs or even at gas pumps.

Pickpocketing: Although identity thieves have begun to use more sophisticated means to commit their crimes, many still prefer good old-fashioned purse snatching or pickpocketing to gain access to your identification and financial information.

Address Diversion: Even though the USPS has put a credit card verification system into place for making an address change, if you’ve lost or had your wallet stolen, identity thieves can easily divert your mail to come to their address with an unauthorized change of address request.

How Common Is Identity Theft?

It’s been estimated by the Federal Trade Commission that as many as 13 million people are victimized by some form of identity theft each year. And with every passing day, identity thieves come up with more ways to steal from hardworking Americans.

That statistic leads us to believe that while identity theft occurs all too often, it isn’t as common as it could be if there weren’t ways to prevent becoming a victim. But with combined personal losses of up to $16 million, identity theft is one of the most costly crimes that you can experience.

So, what can you do to keep from being added to the FTC’s identity theft report? You need to know what to look for when it comes to the activity of identity thieves if you want to have any chance of beating them at their own game. Your first step should be to familiarize yourself with the various kinds of identity theft.

What Are the Different Types of Identity Theft?

Identity theft has become a serious moneymaker for criminals and it’s ranked as the #1 consumer complaint since 2000. The FTC has received hundreds of millions of reports of identity theft in the past two decades, which makes it one of the biggest financial crimes to date.

Educating yourself about where your personal information is most at risk for being stolen can be a big help in how to prevent ID theft from happening to you. There are a variety of ways identity thieves can gain access to your most sensitive data, from more traditional tactics to new and sophisticated online fraud schemes.

These are the 15 most common types of identity theft:

1. Driver’s License Theft

At the top of the list is driver’s license theft, which is where a criminal steals your ID card and uses it to apply for fraudulent bank or credit card accounts in your name. This is the most common type of identity theft and one of the scariest, thanks to the thought of your identity being used for criminal activity.

2. Mail Theft

Mail identity theft is one of the oldest ways for a criminal to steal your personal information. If your mail has been stolen, a thief may be able to retrieve your financial account information to make purchases or open up new credit cards. They could also change your address on your statements or bills.

3. Debit or Credit Card Fraud

Whether a criminal uses your actual credit or debit card to make unauthorized purchases or hacks your online account information to gain access to the card numbers, this type of identity theft is all too common and can lead to thousands of dollars in stolen funds.

4. Social Security Number Theft

When most people think of important personal information, their Social Security Number (SSN) is probably what comes to mind first. Of course, it’s also at the front of most identity thieves minds too, which is what makes this type of identity theft so common. With your SSN, criminals can easily apply for loans or credit cards in your name, as well as get access to even more of your personal information.

5. Synthetic Identity Theft

This is the fastest-growing type of ID theft and it represents up to 85% of all current cases of identity theft. But just what is synthetic identity theft? This type of ID fraud is when your personal information is merged with phony details to create a whole new identity. Criminals then use this new fraudulent information to open bank accounts or take out loans as that fictitious person, many times leaving you holding the bag for their crimes.

6. Account Takeover Theft

This type of ID fraud is when a criminal gains access to your bank or credit card account. They then begin to make unauthorized purchases and might even lock you out by changing the login info or password. Account takeover theft is usually the result of a malware infection or an email phishing scam.

7. New Account Fraud

Another way identity thieves steal money is by using your information to open a new account under your name. They’re able to make fraudulent use of your good credit or established banking relationship to make withdrawals or purchases without you even knowing about it.

8. Senior Citizen Scams

According to the FTC, almost 40% of ID theft complaints were made by Americans aged 60 or older in 2016. Identity thieves target seniors with their scams and prey on them online through phishing schemes, as they know many older people aren’t as tech-savvy, making them an easier mark for being victimized.

9. Child Identity Theft

Children are also favorite targets of identity thieves, as they know most parents won’t think to check on the health of their child’s credit. Criminals use the SSN of young children to open new accounts or take out lines of credit. And nobody is the wiser until the child grows up and tries to apply for their first credit card, only to discover they’re in debt up to their neck, thanks to ID theft.

10. Tax Return Theft

Tax identity theft is also on the rise and usually goes hand-in-hand with SSN theft. Scammers not only fraudulently file your taxes before you get the chance, but they also lie about the number of deductions and other details, so they can get a bigger refund. And of course, they sign up for direct deposit to another account, which means you don’t know you’ve been the victim of tax ID theft until it’s too late.

11. Criminal Identity Theft

This type of identity theft occurs when a criminal gives your name and address to the police during an arrest. This keeps the crime off their record and adds it to yours, which can create some serious issues when you go to apply for a job or happen to get pulled over and discover there’s a warrant out for your arrest.

12. Medical Identity Theft

This form of ID theft can be harder to uncover than most, as it only happens when a scammer uses your information for medical services. Healthcare has become very expensive, which means it’s now an appealing way for identity thieves to steal from you by filing claims with your insurance company or leaving you with hospital bills under your name.

13. Auto or Home Loan Fraud

Another popular ID scam is when criminals use your information to apply for a mortgage or car loan. Many times, these types of identity theft are a team effort, thanks to dealers or lenders being in on the scam, and lying on the loan application. If these types of loans aren’t cross-checked at the time they’re processed, you could end up paying for a car or home that you didn’t even know existed.

14. E-commerce Fraud

Online shopping fraud is on the rise, thanks to more and more cybercriminals hacking into bank or credit accounts. Many times, items are purchased with your financial information and then shipped overseas, and it’s all done without your knowledge. If you don’t check your bank or credit card statements regularly, you could be putting yourself at some serious financial risk.

15. Employment Identity Theft

As strange as it might seem, there are fraudsters out there that want to apply for jobs using your identity. They typically create a synthetic ID with your SSN or driver’s license number, and then report fraudulent income data to the IRS, leaving you on the hook for the taxes the government expects you to pay.

What Are the Warning Signs of Identity Theft?

Now that you know some of the ways criminals use your private data for profit, it’s time to learn the warning signs of identity theft, so you can prevent yourself from becoming a victim. Even though ID theft can be much harder to detect than other types of crimes, there are still some ways to spot the evidence of identity theft.

If you keep an eye out for the common clues that indicate you’ve been the victim of identity theft, you can keep yourself from having to go through the long and arduous process of recovering from ID theft, and prevent your bank account from being drained.

According to the FTC, these are the top warning signs of ID theft:

- You noticed you’re missing bills or other types of mail you were expecting

- You start receiving collections calls from debts you don’t remember having

- You notice purchases or withdrawals from your bank account that you didn’t make

- You discover accounts or charges on your credit report that are totally unfamiliar

- You begin to get invoices for medical services you never sought out or received

- You’re told by a company you do business with that they’ve had a data breach

- You’re denied coverage by an insurance company due to conditions you don’t have

- You’re notified by the IRS that you owe taxes from an employer you don’t recognize

These are just some of the examples of the signs of ID theft. You should also keep an eye out for a sudden dip in your credit rating or any other indicator that there has been any type of financial or medical activity in your name that you don’t recognize.

Am I at Risk for Identity Theft?

By this point, you’re probably wondering if you could become the victim of an identity thief. After all, you’re careful with your personal information, and you make sure to use strong passwords for your financial accounts. We hate to break it to you, but everyone is a risk for identity theft.

Whether you’re shopping online or in-store, taking as many precautions while browsing the Web as possible, or even regularly checking your credit report, you can still have your identity stolen. It doesn’t matter if you’re a student or a retiree, there are criminals out there that are working hard to steal from you each day.

Do you use a credit or debit card to make purchases? Most people use one at least once a day, and they are by far the most targeted type of identity theft, with 4 out of 5 cases dealing with credit or debit card information being stolen and used fraudulently.

Your Social Security Number is also at serious risk of being targeted for theft. Stolen SSNs are used to apply for lines of credit, new bank accounts, and to sign up for fraudulent insurance coverage more than you could probably guess. Starting to see how identity theft can hit anyone at any given time?

You’re at serious risk for identity theft if you:

- Use easy-to-remember passwords online

- Send financial information through email

- Only check your credit report once a year

- Carry your Social Security card with you

- Don’t review credit card statements monthly

- Share private info with people you don’t know

Now that you can see how easy it is to have your identity stolen, we’re going to talk about how simple it is to prevent identity theft by making some small changes to your life or by giving experts the chance to keep your personal info safeguarded for you.

How Can I Prevent Identity Theft?

You might not be able to totally prevent identity theft but there are some things you can do to cut way down on your level of risk. Even if you think you’re already doing all the right things to keep yourself safe from identity thieves, you should check out the following identity theft prevention tips. You can never be too safe, after all, and you just might learn something new.

Easy ways to prevent identity theft include:

- Never give out your SSN unless absolutely necessary

- Don’t provide your personal info to unknown sources

- Always bring your mail inside as soon as possible

- Be sure to install antivirus protection on your computer

- Don’t forget to enable security features on your cell phone

- Contact the USPS if you’re missing bills or bank statements

- Regularly review your credit card statements for mistakes

- Shred any documents that contain your personal information

- Make sure to use unique and complex passwords while online

- Review your credit report at least every three months for changes

Sounds simple enough, right? But we’re only human and all of us can make a mistake or forget to practice good identity theft safety measures each month. If you’re worried about not being able to prevent having your identity stolen by yourself, there are some ways to get professional help, which we’ll talk about later on in this article, so don’t panic just yet!

How Do I Report Identity Theft?

Think you may be the victim of identity theft? You need to let the Federal Trade Commission know about your concerns immediately. Luckily, the FTC makes the process as simple as they possibly can to help you get ahead of this terrifying situation.

You can contact the FTC online by visiting www.IdentityTheft.gov where you’ll be guided step-by-step through reporting your identity theft case. You’ll need to create an account to get a case report and a custom identity theft recovery plan.

Creating an identity theft account with the FTC will allow you to:

- Get the most up-to-date recovery plan

- Track the progress of your specific case

- Receive prefilled letters to send to creditors

You can also report identity theft to the Federal Trade Commission by phone if you call 1-877-438-4338 and speak with an FTC agent. You’ll be asked for the details relating to your case and guided through creating an ID theft recovery plan.

You might be instructed by the FTC to report your identity theft case to your local police department. If so, you should do so as soon as possible by calling the non-emergency number and asking to speak to an officer regarding identity theft.

Reporting ID theft to the police is especially important if you think you might know who stole your identity in the first place or if you’ve been the victim of criminal identity theft, which is where your info has been given to the police in relation to the commission of a crime.

How Do I Recover from Identity Theft?

Even if you’ve been extra careful about keeping your personal information safe and sound, you still might find yourself in the scary situation of having your identity stolen. If so, you need to react as quickly as possible to make sure the damage is as minimal as it can be, and that means taking some steps immediately.

Once you’ve reported the crime to the FTC, follow these steps to recover from identity theft:

- Report any fraudulent activity to the businesses that were involved

- Contact the credit bureaus and place a fraud alert on your credit

- Think about totally freezing your credit to prevent further damage

- Sign up for a reputable credit monitoring service to get future alerts

- Create new strong and unique passwords for all of your online accounts

While reporting identity theft is the crucial first step to getting your life back on track after your identity has been stolen, you also need to work hard to regain your good name. Following the above tips will help you make sure you’ve fully recovered and won’t have to deal with identity theft fallout months (or even years) later.

Is Identity Theft Protection Worth It?

Chances are that you’ve heard about identity theft protection services. You might have even seen them advertised on TV or in your social media newsfeed. And you’ve probably thought it sounds good but you’ve wondered, is paying for ID theft protection really worth it?

While many of the ways identity theft protection companies keep you safe can be done on your own without costing you a cent, most people find that they’re too busy with day-to-day life to monitor their own credit or bank accounts.

Then there’s the fact that ID theft protection providers give you more than just simple ways to prevent identity theft from happening in the first place. The top identity theft prevention companies also give you millions of dollars in ID theft insurance.

That means you don’t have to worry about going bankrupt if your identity ever is stolen. With identity theft insurance, you’ll get compensated for any stolen funds or fees that are incurred during the identity theft recovery process.

Not only will your ID theft protection service monitor for any suspicious use of your personal information, like unauthorized withdrawals or purchases, the unauthorized opening of new accounts, or your Social Security Number being sold on the Dark Web, but you’ll also get help with reporting ID theft to the proper authorities and getting your money (and your life) back.

So, how do you find the best ID theft prevention service? We’re going to help you find out what to look for when it comes to finding the right identity theft protection company for you and the features you should keep an eye out for before you sign on the dotted line.

How to Choose the Best Identity Theft Protection

During our research of the best identity theft prevention services, we’ve discovered that while there are some differences amongst the top companies, there are also some key similarities when it comes to getting the best protection and value.

You should look for these features when picking the best ID theft protection company:

3-Bureau Credit Reports: You wouldn’t check just one of your tires if you thought you had a flat, right? Well, the same holds true for keeping an eye on your credit to make sure your personal info hasn’t been stolen. This means you should choose an ID prevention service that monitors Equifax, Experian, and TransUnion for credit reports from all three credit bureaus.

Offline and Online Monitoring: When looking for a service that monitors for usage of your private data, you want to make sure you’re being notified of all possible issues, whether that means a warning that your online banking account has been hacked or the USPS has received a request to change your address without your consent. Make sure any identity theft prevention company you work with offers both online and offline monitoring to cover all of the bases.

Real-Time Threat Alerts: What good will it do to learn that your SSN has been stolen days after it happened? No matter whether you prefer to be notified by phone, email, text, or some other means, you need to make sure that your identity protection service gives you alerts in real-time, so you’re not left trying to play catchup after your personal info has been used without your knowledge or permission.

Included Legal Support: If your identity is ever stolen, you might need to retain an attorney to go to work for you in cleaning the mess up. That’s why you should look for an ID theft protection service that provides you with no-cost legal representation in the event that you ever become the victim of identity theft. You’ll be able to rest easy knowing that you’re getting premium legal services, without having to pay premium fees for the power that comes with hiring a lawyer.

Identity Theft Insurance: One of the best ways to make sure you’re getting top identity protection coverage is by going with a company that offers $1 million or more in ID theft insurance. If you ever do have to deal with the financial frustration and destruction that goes hand-in-hand with identity theft, you won’t have to worry about paying your bills or feeding your family, thanks to being protected by top-notch identity theft insurance coverage.

When you find an identity protection company that offers all of these benefits, has a user-friendly interface and provides you with reasonable subscription fees, you just might have the perfect ID theft prevention option for you.

Just be sure to check out what current customers have to say by going one step further and reading identity theft protection reviews before signing up for any service. And don’t forget to take a look at the level of online security that’s provided via top-notch data encryption!

The Bottom Line on Identity Theft

To put it simply, if you ever pay your bills online, use a credit or debit card to make purchases in a store, have mail delivered to your home, or communicate via email, you’re at risk for becoming the target of an identity thief.

Even if you’re careful to check your credit report regularly, keep an eye on your financial statements, and shred any documents before throwing them away, there is still a chance that you could have your identity stolen. Scary but true!

That’s the bad news but the good news is that there are identity theft protection services out there that will constantly monitor your personal info for any threats of unauthorized use, let you know if there’s a cause for concern, help you report ID theft, and even get your money back to you if it’s ever stolen.

If you follow the advice in this article and do your research to find the best identity theft prevention service, you just might be one of the lucky few that never have to suffer through the pain and frustration of being the victim of identity theft.